Mar 29, 2021

Oilers’ season has been a tale of two teams

It would take a minor miracle for the Edmonton Oilers to not reach the postseason this year. But, as Travis Yost writes, one of the points of concern with the Oilers so far this season is that they really have been a tale of two teams.

By Travis Yost

It would take a minor miracle for the Edmonton Oilers to not reach the postseason this year.

Playing at a 101-point pace (82-game adjusted) and with an eight-point lead over the Calgary Flames and Vancouver Canucks entering play Monday, Dave Tippett’s team is well-positioned to play beyond the end of the regular season.

Reaching the postseason is not an insignificant milestone. In the six-year era of Connor McDavid in Edmonton, the Oilers have just two playoff berths – a disappointing showing for an organization icing the best hockey player on Earth.

One of those (2019-20) came during the pandemic-paused season, and the Oilers ended up losing in a 3-1 upset at the hands of the Chicago Blackhawks in the qualifying round.

It goes without saying that the organization and fan base alike are looking for a little bit more than qualifying for the round of 16.

But one of the points of concern with the Oilers so far this season is that they really have been a tale of two teams.

There is one that pummels lower-tier teams, especially ones that can’t contain the pace and speed of the Oilers’ attacking units.

There is a second that struggles when the competition stiffens. To be sure, it is not merely the fact that the Oilers have had a hard time accumulating wins against more talented clubs. It is more so how significant the splits in performance between the two are.

The North Division already has notable separation between playoff and non-playoff teams – Toronto, Edmonton, Montreal, and Winnipeg all have an 85 per cent or greater chance of qualifying. As such, we will bifurcate the division into two and measure results.

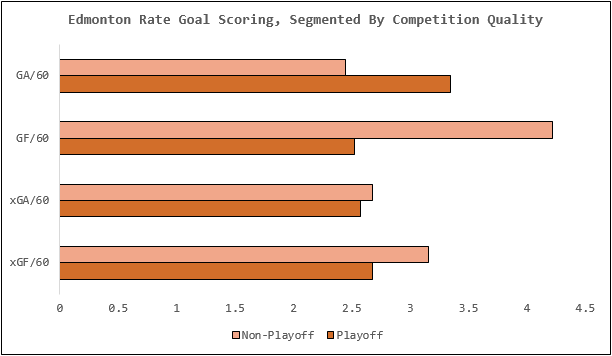

Edmonton is 7-9-1 against playoff-bound teams, and 13-5-0 against non-playoff teams. That’s well within reason. But consider the splits underpinning those games:

The Oilers have absolutely bludgeoned the weaker teams in the North, outscoring them 76 to 44 (+32) in the process. The opposite has been true against tougher competition, with the Oilers being outscored 57 to 43 (-14) there.

Expected goal rates indicate that Edmonton’s had a bit of poor luck against the playoff teams, but consider the splits there between playoff and non-playoff teams. On the offensive side, the Oilers have been about 15 per cent less effective at creating dangerous offence.

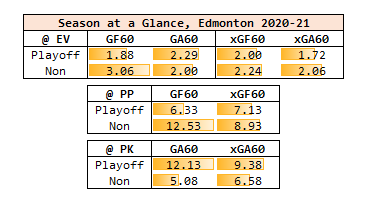

Some of this is percentage driven. The shooting and save percentage splits, as one would envision from the rate goal numbers above, are significantly variant:

- Against playoff teams: 13.3 per cent shooting for, 7.8 per cent shooting against

- Against non-playoff teams: 8.4 per cent shooting for, 11.0 per cent shooting against

Another important point: Edmonton seems to be trading these goals off everywhere when they have to step up against better competition.

The one area that has held, ironically enough, has been their defensive play at even strength. But scoring at even strength has been a nightmare for the Oilers against playoff-calibre clubs, and those failures so far this season carry over (significantly) to the man advantage.

Compounding the issue: a penalty kill that looks Jekyll and Hyde, depending on who they are playing:

If you aggregate just the special teams results here, you can explain why Edmonton is in the middle of the playoff pack instead of sitting atop the division.

Against playoff teams, the Oilers net special teams advantage is -7 goals, and we know that’s the result of a slowed power play and a leaky penalty kill. In nearly the same amount of minutes against non-playoff teams, the Oilers are +13 goals better than their opponents – a 20-goal swing between the two.

Outside of the superstars (and even they have had a relative step down in performance) in McDavid and Leon Draisaitl, the entire team just hasn’t been good enough against tougher competition.

The good news? They have seven more opportunities against the Toronto, Montreal, and Winnipeg triumvirate, and a chance to position themselves for a run beyond postseason qualification.

Data via Natural Stat Trick, Evolving Hockey, NHL.com