Mar 21, 2022

Finding value at the NHL trade deadline

The National Hockey League trade deadline is the last in-season opportunity for teams to make a material impact on their outlook. Travis Yost has more on deadline day.

By Travis Yost

The National Hockey League trade deadline is the last in-season opportunity for teams to make a material impact on their outlook.

Buyers focus on the short term, eyeing prizes won during the NHL postseason. Sellers, on the other hand, focus a couple of years out, more hopeful that draft capital and salary cap flexibility will position them advantageously by the time they’re competitive again.

For buyers, it is a razor’s edge to walk. Sellers know how significant trade deadlines are for teams in arms races, and even though they may be under pressure of their own (Philadelphia, for example, could not wait much longer on a Claude Giroux trade), buyers can ill-afford to lose out. This is where the NHL deviates from other North American sports leagues. For a variety of reasons, buyers operating in the NHL’s marketplace routinely overpay to chase the smallest margins of competitive advantage remaining.

Whether or not these prices are appropriate will invariably be the subject of an off-season piece here. But right now, I want to focus on the players who are available, and which of those players may be a value find. Because even though the odds are stacked against buyers, we still see teams win these deals from time to time. (As an example: a month before the 2019-20 trade deadline, Vegas acquired future top-six centre Chandler Stephenson for a fifth-round pick.)

One of the best ways to tease out value in relation to market perception is to trim volatility and acknowledge team-level effects. Teams, now more than ever, look at on-ice results to understand player impact. A player who has – in the short to medium term, anyway – benefited from uniquely great goaltending or shooting talent around him may not be as clean a fit with another organization.

Conversely, a player whose production has been stung by porous goaltending behind him or weak shooting talent around him may look much better after a trade, even though those external factors tend to have a significant impact on the price to acquire a player.

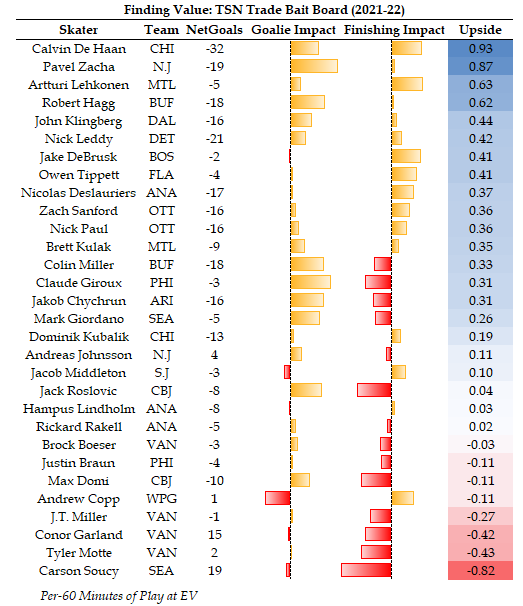

How would we apply this in practice? Let’s take the top 30 skaters (as of Sunday morning) from TSN’s Trade Bait Board, a hierarchy of players weighted based on likelihood of them being moved and implied value. Let’s also look retrospectively at their past two seasons, with a focus on on-ice impact. In this case, we will control both for the goaltending they realized, as well as the rate at which they beat scoring expectations offensively.

How do we make sense of this? Let’s look at the extremes in Montreal’s Artturi Lehkonen and Seattle’s Carson Soucy as two examples.

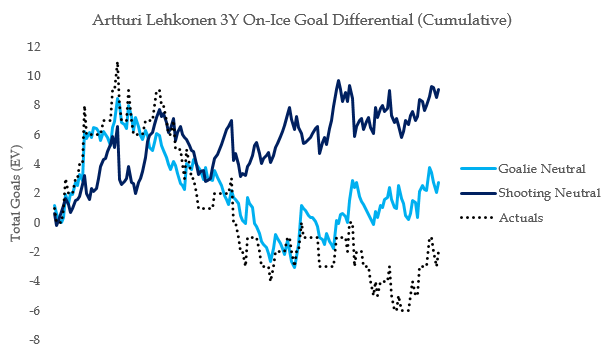

Lehkonen is an established bottom-six forward with muted offensive upside. This year withstanding, Lehkonen’s been able to keep himself in NHL lineups by playing with frenetic pace and being a very responsible defensive option, perhaps a crown jewel of what a modern-era checking line would look like.

He’s also an interesting player because amongst TSN’s upper-echelon Trade Bait Board types, he’s been the player most adversely impacted by his surroundings. Not only has Lehkonen played with similarly poor shooters, he’s also been crushed by shoddy goaltending behind him. If you look at the past few seasons, our expectations of the impact Lehkonen could have on a game are washed aside by these (mostly) external factors:

That’s a shift our perception of Lehkonen. Lehkonen is, to some degree, contributory to his own on-ice shooting percentage woes. But a career nine per cent shooter, like Lehkonen is, should be enough to carry a fourth line. You can discount this however you deem appropriate. But by and large, Lehkonen should be about 12 goals better than what his numbers suggest. That’s no longer Lehkonen territory, it is Chicago’s Tyler Johnson (+11) or Calgary’s Mikael Backlund (+11) territory.

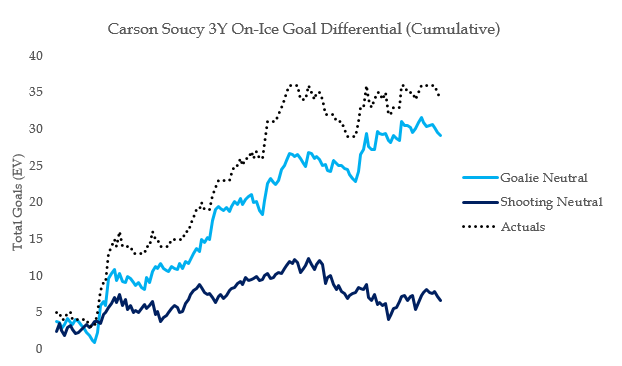

Other side of the equation is Seattle defenceman Carson Soucy. Soucy has had a bit of a breakout year in his third professional season, playing alongside Jamie Oleksiak and Mark Giordano. Seattle’s numbers, particularly offensively, are blistering with Soucy on the ice. That’s an interesting dichotomy, since he’s the archetype of a hulking defender who is used aggressively on penalty kills and sparingly on power plays. At any rate, let’s look at Soucy’s last three seasons:

What is this three-year outlook telling us? For starters, few players have seen more extraordinary shooting luck than Soucy. Soucy himself has just 13 goals on 153 shots (8.4 per cent), but his team has shot a whopping 10.5 per cent with him on the ice, juicing goal differentials in an extraordinary way.

To put this in context, only 20 players around the league have a heavier on-ice shooting percentage than Soucy – think players like Washington’s Evgeny Kuznetsov, Tampa Bay’s Steven Stamkos, and New York’s Artemi Panarin.

Those players, by and large, have driven big offensive numbers. They are wondrous playmakers and gifted shooters. More importantly, they are forwards, and have a more predictable impact (in both directions) on something like shooting percentage.

Even a generous interpretation of what Soucy could provide – clean transitions, the opening of passing lanes for shooters in the offensive zone, and on – could hardly explain why Colorado’s Cale Makar is the only other defender in his stratosphere.

For a team like the Kraken, Soucy is the exact type of player you look to move on from if a trade manifests. The likelihood of Soucy’s future on-ice impact matching what we have seen in years past is quite low. And though it’s not a criticism of Soucy the player, the reality is luck has shined brightly on the 27-year-old blueliner.

To that end, the Kraken front office has one job ahead of the deadline. It’s to make another front office believe Soucy is having this sort of impact, rather than just having some real good fortune over the past few seasons.

Data via Natural Stat Trick, NHL.com, Evolving Hockey